Artificial intelligence (AI) has become the hottest investment trend over the past year and a half, and there’s a good chance that the rapid proliferation of this technology will continue to be a key growth driver for the stock market over the next decade as well.

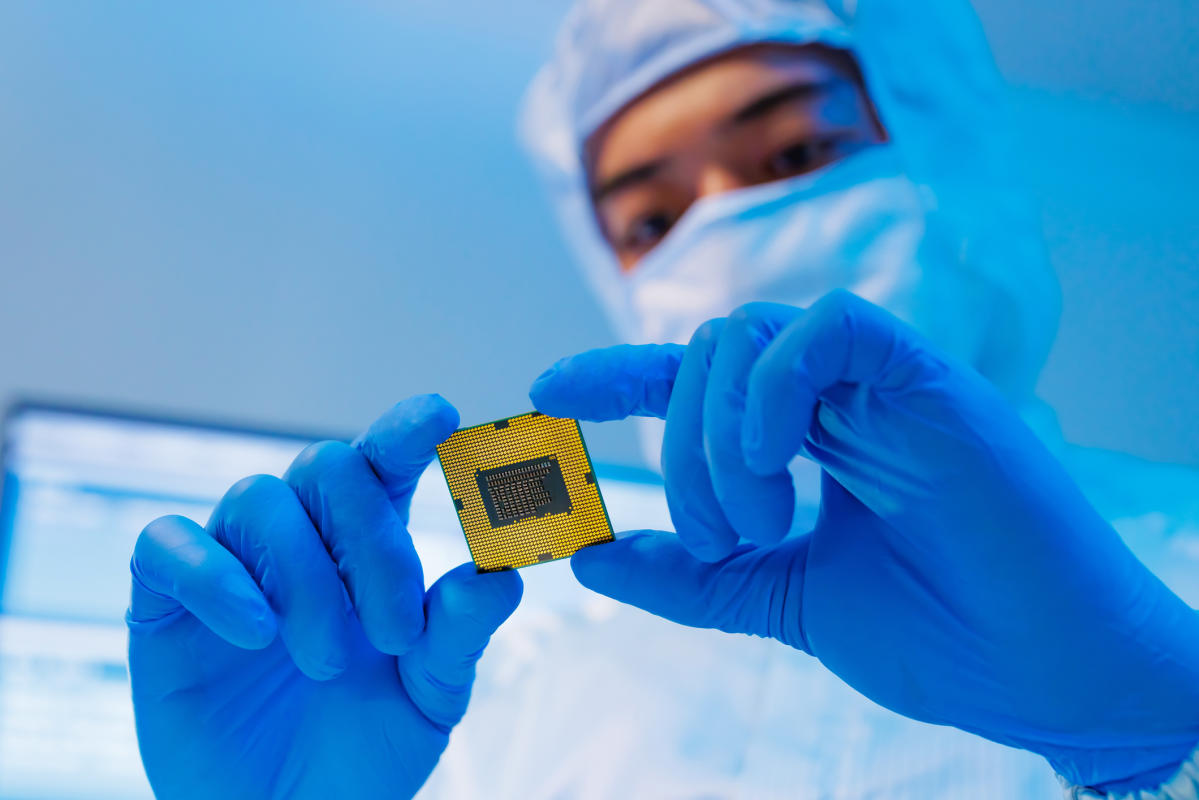

After all, the global AI market is expected to generate nearly $2.6 trillion in annual revenue in 2032, up from an estimated $538 billion last year. Buy and stay strong semiconductor stocks long term is one of the best ways to capitalize on this immense opportunity. Indeed, training and deployment of AI models is not possible without AI chips.

This explains why big businesses and governments have been queuing to buy chips people like Nvidiasending the graphics specialist’s stock soaring on its stunning earnings and profit growth. However, you should also consider buying another chipmaker to make the most of the AI boom: Semiconductor manufacturing in Taiwan (NYSE:TSM).

TSMC is a strong player in the AI chip boom

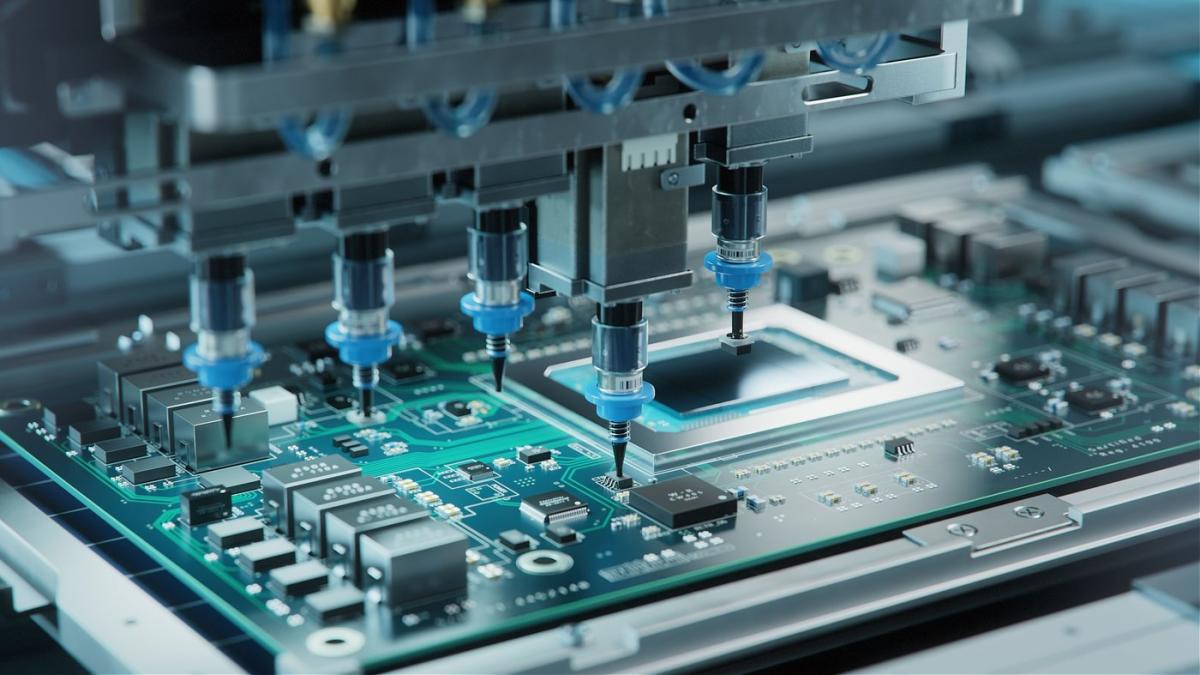

Popularly known as TSMC, the Taiwan-based foundry giant is at the heart of the AI semiconductor market as its process nodes enable customers such as Nvidia to produce powerful chips. For example, Nvidia’s Hopper architecture, which helped the company become the dominant player in the AI chip market, was based on TSMC’s 4N manufacturing process.

And now, Nvidia will manufacture its next-generation Blackwell AI processors using TSMC’s 4NP process. However, Nvidia isn’t the only one lining up to get their hands on TSMC’s chips. Intel reportedly leveraged TSMC’s 3-nanometer (nm) chip production line to make laptop processors.

It’s worth noting that Intel itself is a chipmaker, unlike Nvidia, which only designs its chips and outsources their manufacturing to TSMC. However, Intel has fallen behind in the race to develop advanced chips, which is why it has tapped TSMC for manufacturing. Given that TSMC has consistently pushed the boundaries in product development and is poised to move to more advanced process nodes, such as 2nm, it will not be surprising to see continued demand from ‘Intel and Nvidia.

It turns out they’re not the only chipmakers looking to TSMC to support their AI ambitions. From Qualcomm has AMD has Apple has Broadcom has Marvell Technology, TSMC’s customer list is long and illustrious. As a result, the company’s plant utilization rate remains very high. For example, TSMC’s 3nm chip production line reportedly had a 95% utilization rate last month.

Such strong demand explains why TSMC’s business is booming in 2024. Its revenue in the first five months of the year was up 27% year over year. This is a nice turnaround from last year, when the company’s revenue fell due to weak end-market demand. Looking ahead, TSMC’s revenue growth is expected to remain strong as the company capitalizes on its formidable 62% foundry market share…

Discover more from The Times Of Update

Subscribe to get the latest posts sent to your email.