In the mid-1990s, the arrival of the Internet opened new doors for American businesses and forever changed their growth trajectory. But for more than a quarter century, investors, both professional and ordinary, have been wondering what transformative innovation will be next to rival what the Internet has brought to business. Artificial Intelligence (AI) seems to be the obvious answer to this long-standing question.

With AI, software and systems are overseeing tasks that would previously have been left to humans. What gives AI such vast potential (PwC estimates that artificial intelligence could add $15.7 trillion to the global economy by 2030) is the ability of software and systems to learn and evolve. without human intervention.

While AI stocks have been virtually unstoppable over the past 18 months, a shift in AI euphoria may be brewing, with Nvidia (NASDAQ: NVDA) being the culprit behind this.

Nvidia’s exploitation ramp has been virtually flawless

Before we get to the negatives, let’s give credit where credit is due. Semiconductor giant Nvidia has leveraged its first-mover advantage to become the leading provider of graphics processing units (GPUs) in AI-accelerated data centers.

According to an analysis by TechInsights researchers, Nvidia accounted for 3.76 million of the 3.85 million GPUs that were shipped to enterprise data centers last year. For those of you wondering, that’s a 98% market share.

In addition to its first-mover advantage, Nvidia holds clear computing advantages over its competitors. Intel (NASDAQ:INTC) And Advanced microsystems (NASDAQ: AMD) As Nvidia tries to catch up on the much-anticipated H100 GPU, Nvidia is preparing to roll out its next-generation GPU architecture, known as Blackwell. In June, CEO Jensen Huang also teased Blackwell’s successor, known as Rubin, which is expected to hit the market in 2026.

Demand for Nvidia’s chips has also outpaced supply. When a high-demand commodity is in short supply, it’s not unusual for the selling price of that commodity to increase significantly. Nvidia was able to price its H100 to (at one point) more than $40,000 per chip. The end result is a notable expansion of the company’s adjusted gross margin to 78.35% in the fiscal first quarter (ended April 28).

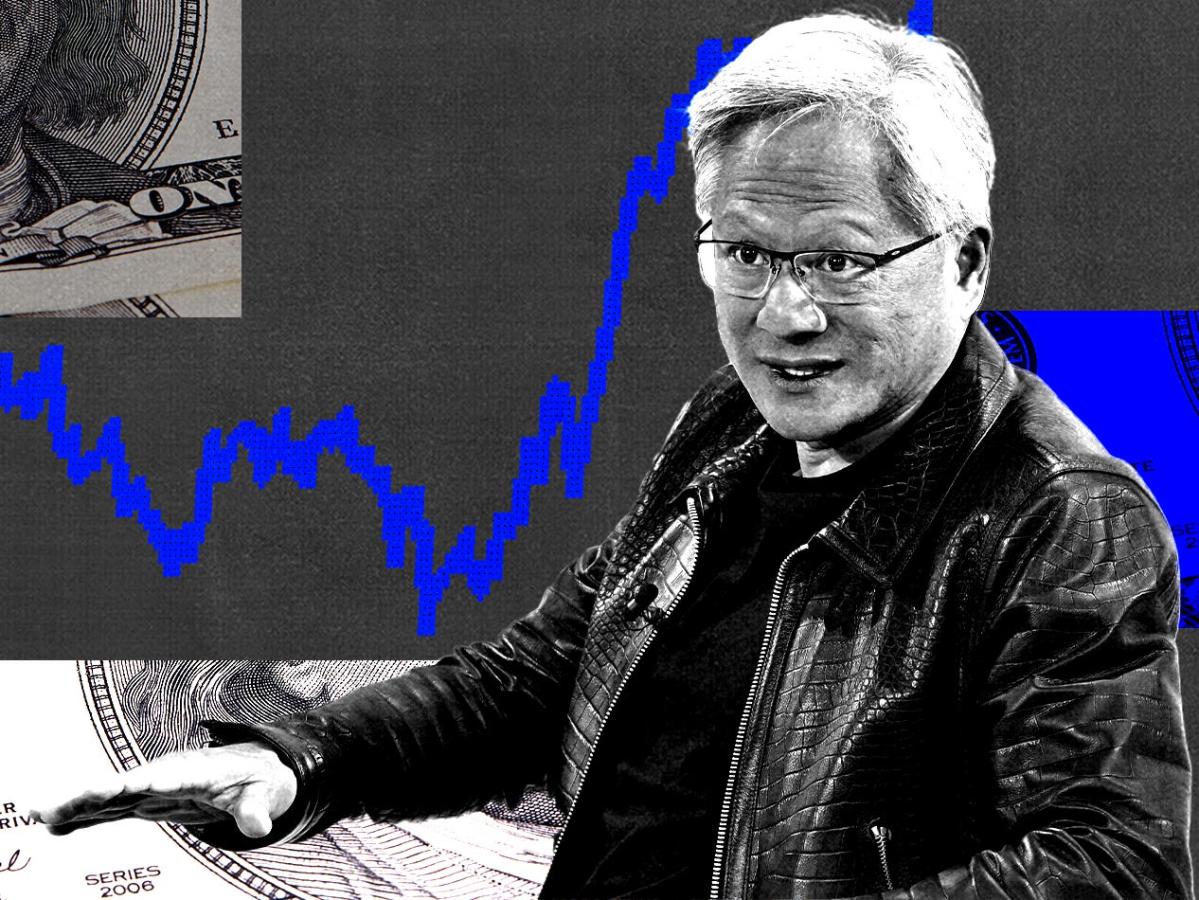

The AI revolution has sent Nvidia’s stock up 706% since the start of 2023, boosting its market cap by more than $2.7 trillion. It was this historic rise by one of Wall Street’s most influential companies that prompted the company’s board to implement a 10-for-1 stock split in June.

However, Nvidia’s glory days may prove short-lived.

Nvidia’s own forecast is an ominous warning of the challenges ahead

Despite Wall Street’s efforts to reach new heights, Nvidia has beaten revenue and profit forecasts in each of the previous five quarters. But the company’s adjusted gross margin forecast for the fiscal second quarter offers a healthy gross margin.

Discover more from The Times Of Update

Subscribe to get the latest posts sent to your email.