By Paritosh Bansal

(Reuters) – A bond market anomaly that has reliably predicted a U.S. recession in the past could normalize this year in a highly unusual way. This is a worry for the markets.

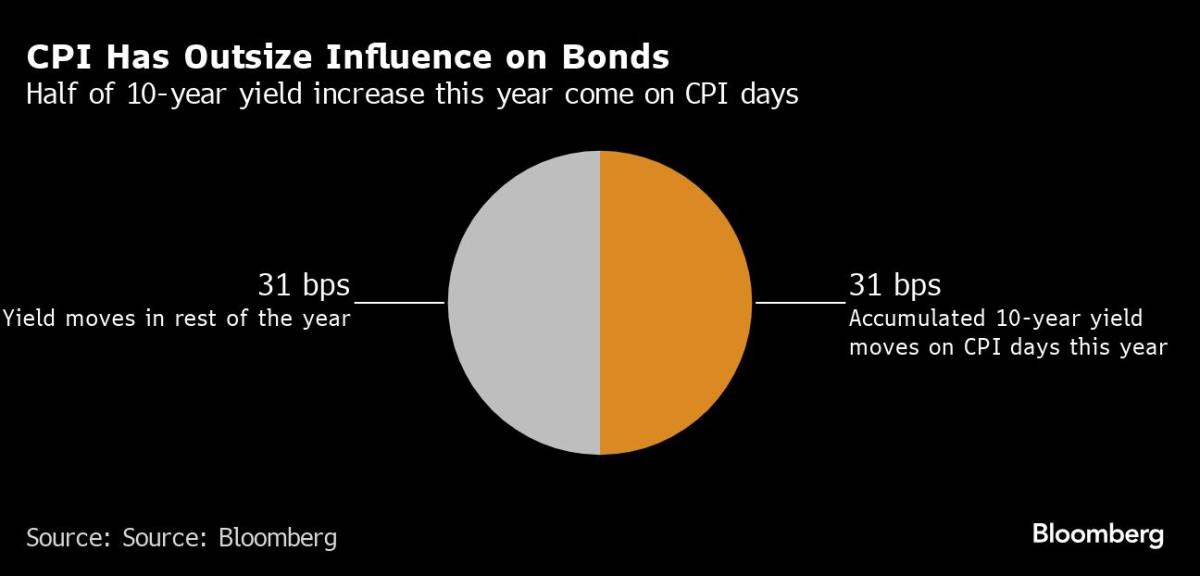

The market signal, called the yield curve, has been upside down since early July 2022, with investors less likely to lock up their money for longer periods than shorter ones. The U.S. benchmark curve shows that yields on 2-year Treasuries are about 30 basis points higher than those on 10-year bonds.

In the past, yield curves typically ended up right-side up when an economic downturn led the Federal Reserve to cut interest rates, which lowered yields on short-term policy-rate-sensitive bonds, a phenomenon called bullish steepening.

This time, however, it appears the curve could normalize because long-term bond yields would rise amid a bearish steepening, interviews with a half-dozen investors and others show market experts. This is due to pressure on long-term rates from rising U.S. debt, while a surprisingly robust economy and persistent inflation prevent the Fed from cutting rates.

A bearish steepening, which briefly emerged in October, could resume at some point this year, returning the yield curve to normal in a path rarely taken.

“What we saw at the end of 2023 was the start of this normalization of the curve,” said Dan Siluk, portfolio manager at Janus Henderson. “We will continue this theme until the end of 2024.”

The shape of the curve and the reasons for its steepening have important implications for the real economy and for Wall Street. The yield on the 10-year Treasury note would need to rise above 5% for the curve to normalize, investors said, which would raise interest costs for businesses and consumers. Inflation would remain stable in a scenario of accentuated downward trend.

Although a normal yield curve is beneficial for banks, a downward steepening would be difficult to trade and would put pressure on stocks, which could lead to market fluctuations.

Furthermore, the normalization of the curve would not mean that the economy would have avoided a recession. Higher long-term interest rates could make an eventual slowdown more likely, and high debt levels would hamper the government’s ability to respond.

“It’s too early to consider this a false signal,” said Campbell Harvey, a professor at Duke University who first proposed the inverted yield curve as a recession indicator. “It is negative that long-term rates are increasing.”

Harvey pointed out that the time it takes for a downturn to manifest after an inversion varies and that in the four most recent inversions, the curve turned positive before a recession began.

THUMB HIGHER

Certainly, a bullish steepening could also occur. High policy rates could further slow the economy, weaken the job market and hurt consumers, leading the Fed to cut rates. High interest rates could also cause a market ruction, such as a banking crisis, that would force the Fed to lower rates.

But investors said that in the absence of that, conditions…