(Bloomberg) — Federal Reserve officials are poised to get further confirmation that progress against inflation has stalled, supporting what appears to be a shift in tone toward keeping interest rates higher higher than expected for longer than expected.

Most read on Bloomberg

Policymakers’ favorite inflation gauge – the personal consumption expenditures price index – likely remained elevated in March, according to data expected next week.

This measure is expected to accelerate slightly to 2.6% on an annual basis as energy costs rise. The core indicator, which excludes energy and food, is expected to rise 0.3% from the previous month, following a similar rise in February.

While the core PCE data may not be as strong as the Consumer Price Index – which beat estimates and rattled markets earlier this month – Fed Chair Jerome Powell , and other officials have signaled that it will take more time to gain the necessary confidence in a downward path for inflation before cutting rates.

Read more: Fed resets cut clock, questions whether rates are high enough

Policymakers will observe the traditional public speaking blackout period over the coming week, before their two-day meeting ending May 1.

Friday’s new inflation figures will be accompanied by personal spending and income figures for March. Against a backdrop of healthy job growth, economists forecast another solid rise in household spending on goods and services. Revenue growth is also expected to accelerate.

Other data this week included the government’s initial estimate of first-quarter growth, which likely slowed from the robust pace of the previous period but remains above what policymakers consider sustainable long-term.

A composite indicator of manufacturing and service provider activity will also be released, as well as new home sales. Later this week, the University of Michigan will release its final April reading on consumer confidence and inflation expectations.

What Bloomberg Economics says:

“Real GDP likely slowed to a pace of around 2.7% in the first quarter, following average growth of 4.2% in 2H23. This remains above the long-term sustainable pace of 1.8%, according to FOMC projections, suggesting persistent inflationary pressures. Looking ahead, activity will be challenged by weak discretionary spending as consumers become increasingly price sensitive amid high inflation.

— Anna Wong, Stuart Paul, Eliza Winger and Estelle Ou, economists. For a full analysis, click here

Looking north, the Bank of Canada’s summary of deliberations will shed more light on the debate among officials over what they want to see before cutting rates. Retail sales for February and a flash estimate for March could confirm signs of a slowdown in consumption at the start of the year.

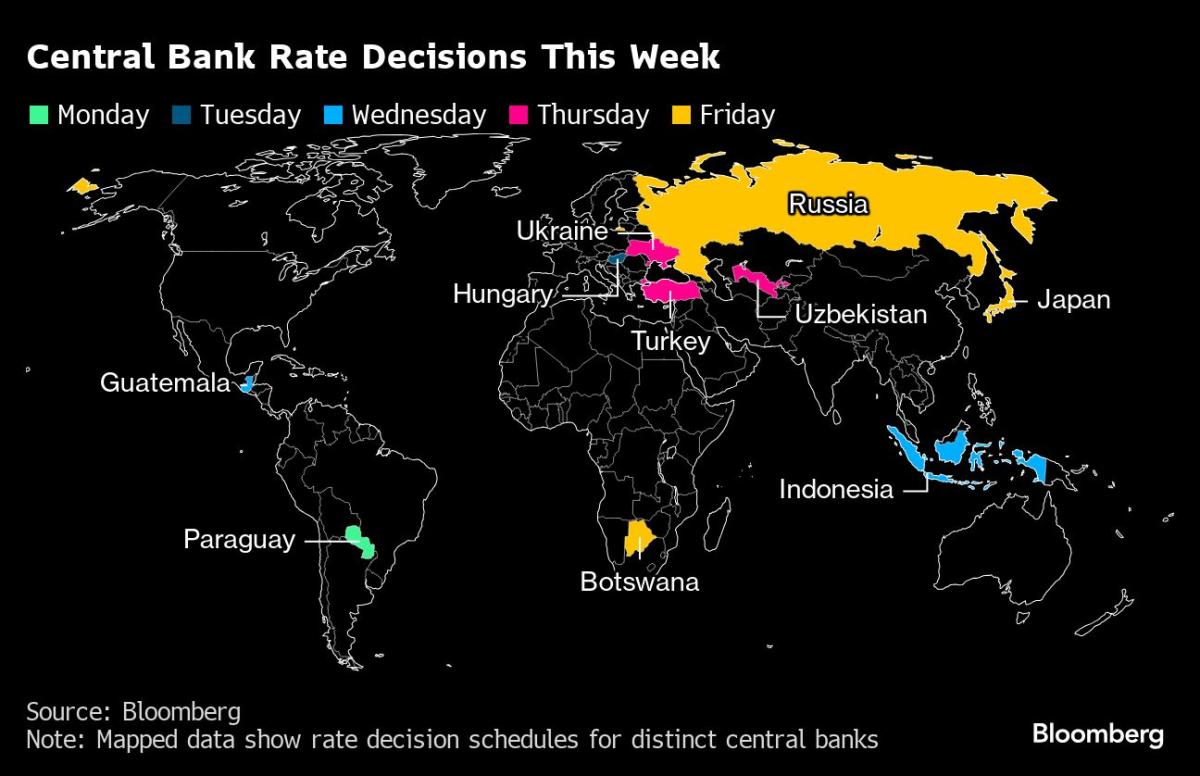

Elsewhere, the Bank of Japan’s decision will be scrutinized for clues to future rate hikes, Turkish officials may keep borrowing costs on hold, Germany’s Ifo corporate index may signal improvement and countries like Australia and Mexico are expected to publish their inflation figures.

Click here to find out what happened last week and below you’ll find our summary of what’s happening in the global economy.

Asia

The BoJ will publish its latest price forecasts, just over a month after its first rate hike since 2007.

While Japan’s central bank is widely expected to keep policy unchanged after shelving its massive easing program, economists and investors will be scrutinizing the forecasts and characterization of inflation risks by the BoJ to get clues on the pace of future rate hikes.

The yen’s continued weakness will add an additional layer of tension when Governor Kazuo Ueda speaks at a briefing after Friday’s decision.

The week starts with Chinese banks expected to keep their prime interest rates unchanged.

South Korea’s preliminary export figures will provide insight into the strength of global trade. The trade-dependent country releases gross domestic product figures on Thursday, and the economy is expected to have grown at the same pace as in the previous four quarters.

Indonesia’s central bank is expected to keep borrowing costs unchanged at 6%.

Singapore, Australia and Malaysia release their inflation figures during the week, with monthly figures from Down Under expected to show the first acceleration since September.

Australia will cut growth prospects for most major economies, including its biggest trading partner China, when it releases its budget next month, Treasurer Jim Chalmers said on Sunday.

Europe, Middle East, Africa

European Central Bank President Christine Lagarde will deliver a speech Monday at Yale University as she extends her visit to the United States following meetings of the International Monetary Fund and the World Bank.

Back in Europe, several colleagues are expected to speak in the coming days. They include Isabel Schnabel and Piero Cipollone, members of the ECB executive board, as well as governors including Joachim Nagel, François Villeroy de Galhau and Fabio Panetta.

Main Eurozone publications include consumer confidence…