A look at the day ahead in the US and global markets by Mike Dolan

Wall Street’s tech stocks’ surge to new records has seen $3 trillion AI champion Nvidia replace Apple as the world’s second-most valuable company in a market steeped in enthusiasm for the reduction of interest rates within the G7.

As the European Central Bank prepares to follow the Bank of Canada on Thursday with its first interest rate cut of the cycle, four countries in the G7 economic bloc will be in easing mode – and two more will be later this year.

To balance things out, the foreign exchange markets are taking it on the chin – with the Euro and the Canadian dollar being relatively calm on the exchanges despite the movements.

This is mainly because speculation about a Federal Reserve rate cut is also resurfacing. After going from at least six 2024 cuts at the start of the year to just one last week, Fed futures are now settling for two quarter-point cuts – starting in September, before the elections.

A series of U.S. labor market reports this week support the argument that the economy is slowing, with Friday’s nationwide payrolls update expected to be key and enrollment updates weekly unemployment and layoffs in May are expected on Thursday.

But the report that really catalyzed stocks’ latest push to new records was last month’s ISM survey of the services sector, which both eased concerns about an economic shutdown and buoyed hopes of continued disinflation.

Although sister surveys on manufacturing show signs of running out of steam, the services sector rebounded strongly in May, with its “prices paid” component slowing and employment still contracting.

Something for everyone perhaps – certainly enough to propel the S&P500 and Nasdaq to new all-time highs on their best day in over a month and drive 10-year Treasury yields to their lowest level in the 1st of April.

The VIX “fear index” is moderate below 13 and S&P futures held their gains before the bell on Thursday.

Scores heading into the half are 2024 gains of more than 12% for the S&P500, more than 14% for the Nasdaq, and 4.5% for the equal-weighted S&P.

All it shows is that technology and its relentless theme of artificial intelligence is once again dominating.

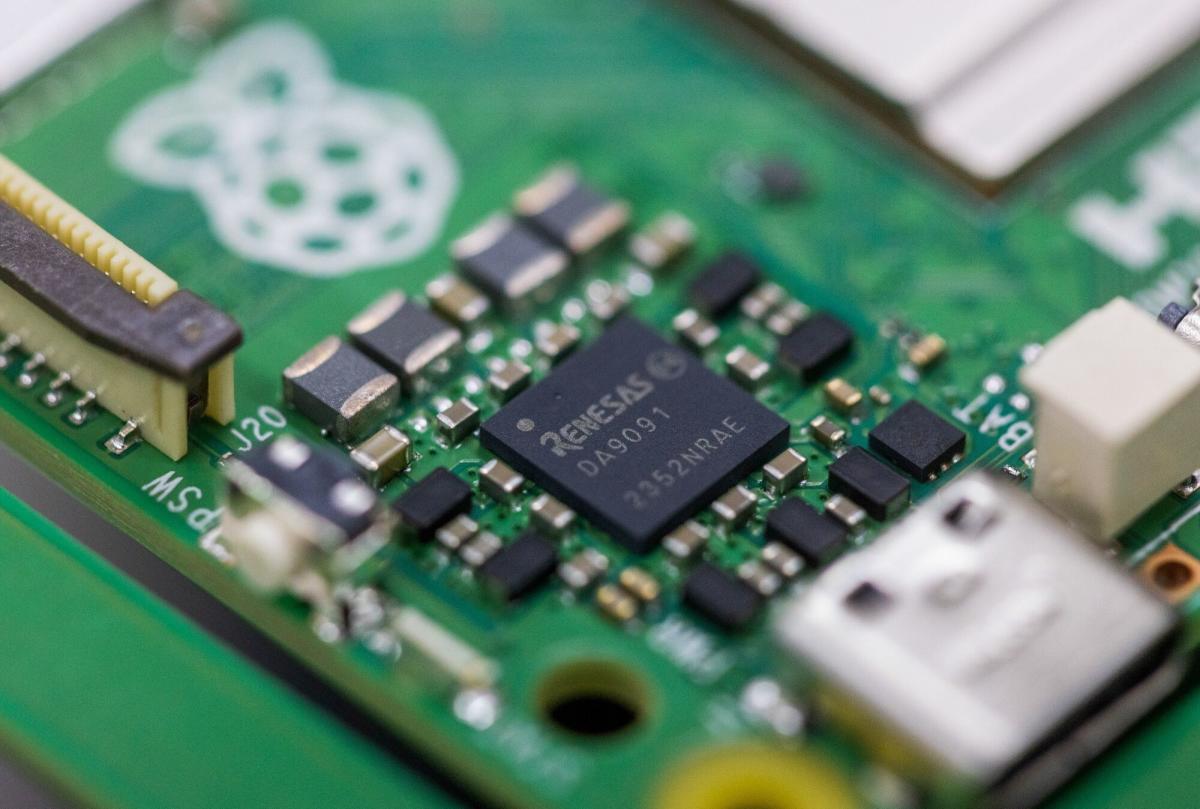

With a market capitalization of $3 trillion for the first time, putting it second behind Microsoft after shares rose 147% this year, Nvidia has reached new highs and taken the entire gaming complex with it. AI companies.

Part of the latest rush is because Nvidia is preparing to split its shares ten-for-one, starting Friday, and those who hold shares at market close today will be entitled to nine additional shares in the flea group.

However, in a possible crossfire, the New York Times reported that the US Department of Justice and the Federal Trade Commission have reached an agreement that allows them to launch antitrust investigations into the dominant roles that Microsoft, OpenAI and Nvidia play. in the market. AI industry.

Other earnings-related increases included gains of more…