Stocks face a familiar problem.

Even though first-quarter earnings are better than expected, the market has struggled to climb consistently as rising Treasury yields weigh on sentiment in stocks, reminding investors of the 2023 period when higher yields high prices caused stocks to collapse.

“Rising rates are now a systemic problem for stocks,” Michael Kantrowitz, Piper Sandler’s chief investment strategist, wrote in a weekly note to clients Friday.

Kantrowitz highlighted market developments over the past month, which could be simplified to a basic formula: When Treasury yields rose, stocks fell. And recently, yields have soared. The 10-year Treasury yield has risen more than 40 basis points to 4.63% since early April, its highest level since November 2023. During that time, the S&P 500 has fallen. about 3%.

“At this point, it’s very difficult to imagine stocks going up without rates falling,” Kantrowitz said in a video of his research distributed to clients.

The same action could be seen in the two-year Treasury yield, where Evercore ISI’s Julian Emanuel reported 5% as the key technical level. which weighed on stocks during last year’s bond sell-off. Notably, stocks’ recent decline from their April highs occurred as the two-year period hit 5%. On Monday, the two-year rate stood at 4.98%.

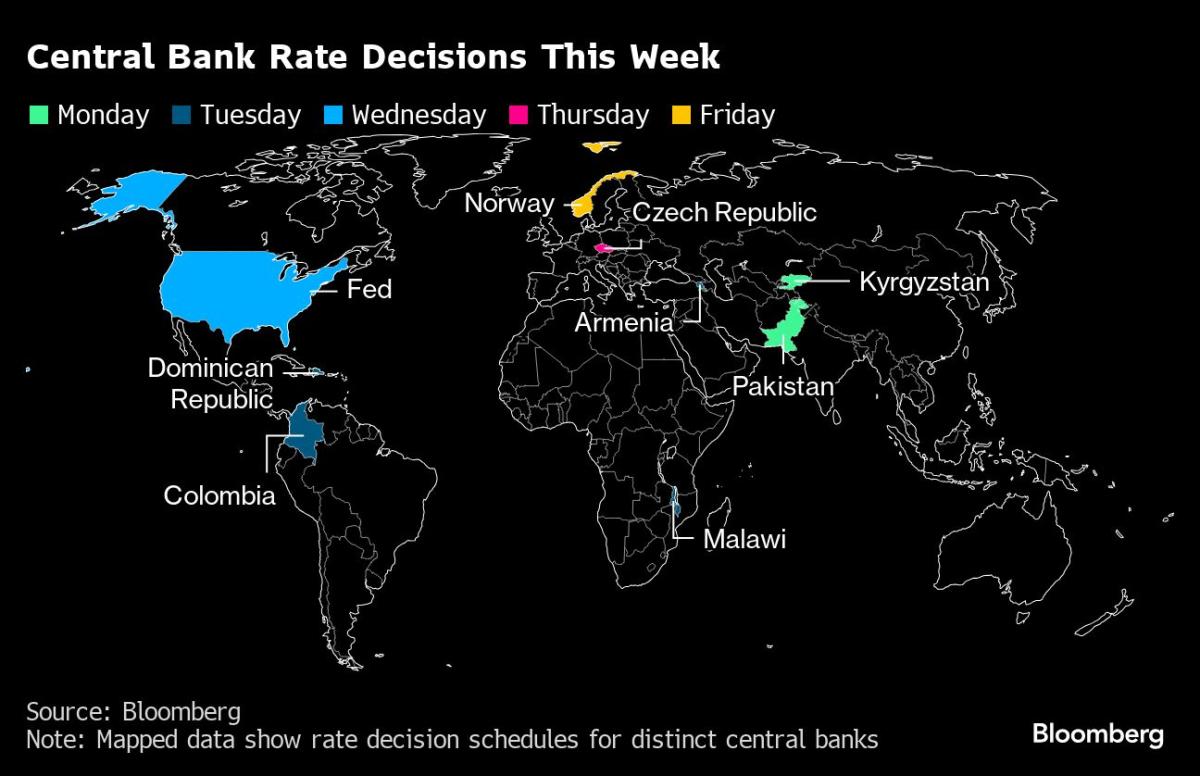

The rise in yields came as investors significantly reduced their bets that the Federal Reserve will cut interest rates this year. Market expectations have fallen from nearly seven cuts to about just one in 2024, according to Bloomberg data. And Morgan Stanley Chief Investment Officer Mike Wilson wrote in a research note Sunday that upward pressure on yields is likely to persist unless Fed Chairman Jerome Powell “surprises on the dovish side.” during his press conference on Wednesday.

Given recent high inflation numbers, economists don’t expect that to be the case when Powell speaks.

“We hope the main message from the press conference will be that policy needs more time to work,” Michael Gapen, a U.S. economist at Bank of America, wrote in a research note ahead of the event. “Powell is expected to indicate that the next move will likely be a rate cut, but the Fed will remain in wait-and-see mode until it gets the inflation confidence it wants.”

This would be a reiteration of Powell’s earlier comments, which did little to provide relief to the bond market.

Rising yields also helped explain why the S&P is down nearly 3% this month, despite a better-than-expected first-quarter earnings season so far. S&P 500 companies beat earnings estimates by 9% on average this quarter, the most since 2021 according to Wilson, but stock price reactions were “muted.”

“We believe this is due to pressure on valuations from rising rates,” Wilson wrote.

And strategists don’t see this trend changing in the short term.

“While ‘higher for longer’ rates are not necessarily an insurmountable obstacle for stocks, some parts of the stock market are more so…